Embarking on a founder’s journey is somewhat like building an airplane in that it takes a variety of skills to get it right, and failure can be disastrous. Yet, most founder teams lack all the skills and knowledge necessary for their startup to take flight, so learning new skills on the job is a common challenge. While giving a novice aviator the responsibility of building an airplane from scratch with little or no support would be considered immoral by most, investors provide capital and encourage aspiring entrepreneurs to risk their livelihoods, homes, relationships, and mental health without helping to arm them with the skills they need to be successful. Being committed to a founder’s success requires much more than just capital to significantly reduce execution risk and help ensure that their company keeps climbing higher.

Is It Better to Get Twice the Investment or 10X the Efficiency?

Psychologists estimate that the average person makes 35,000 decisions in a given day. When we are faced with new challenges, each decision requires a rigorous mental calculation, but as we gain experience, we learn to recognize patterns allowing us to make decisions much faster. You doubtless have experienced this in your own life when learning various skills such as business accounting or even a spreadsheet program. You become a whiz with practice and experience, but when you first start out, it seems that you can’t go on for more than two minutes before getting stuck on something.Â

I have experienced this in my own career when starting out as a junior user-centered designer. It would often take me two to three days to design a screen, stressing and contemplating every interaction. Fast-forward five years later and that same screen would take me just two or three hours to design, and the end product was better. Others have likely experienced how much more efficient skilled professionals are than newbies. Founders of early-stage startups have to constantly perform tasks and learn skills that are new to them, which can lead to disastrous execution without the right support.

No founders are experts at everything that is required of them. Instead, they either spent their career specializing in a given skill or come with little practical experience. Even the most brilliant computer scientist will likely be befuddled when first trying to find viable go-to-market channels or drafting website copy. At the same time, a product manager that spent her career in a corporate setting will likely struggle to lead product effectively in the startup’s resource-constrained environment and break-neck pace. The gap to becoming proficient in these new skill-sets leads to operational risk that neither founders nor investors address with sufficient urgency.

While everyone seems to obsess with the size of funding rounds and valuations in the startup world, it takes just a little googling to find examples of once high-flying companies that raised gobs of money and yet crashed spectacularly such as LeSports, which raised $1.7 billion and failed. What does it matter if a startup raises twice the capital if the team squanders months of resources pursuing dead-ends or fumbling unaided to develop critical skills?

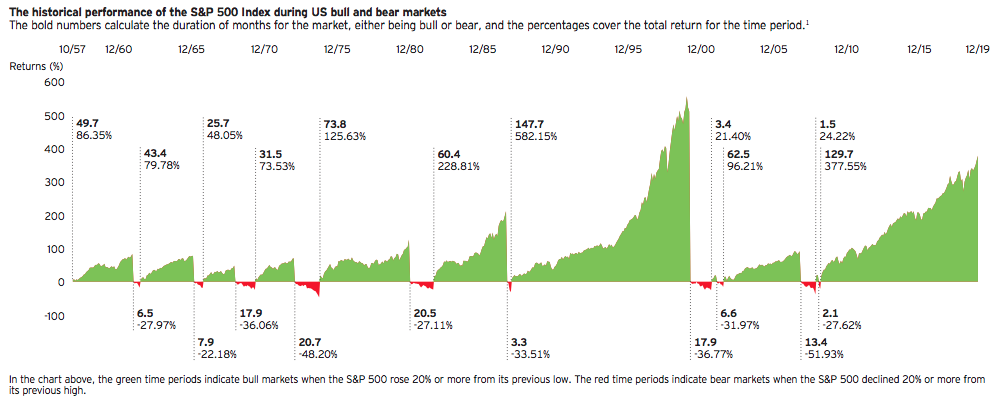

While market booms come and go on average every 4.7 years and hot news headlines fizzle out, one trend is here to stay: skilled, experienced teams build fundamentally strong businesses that flourish in booms and can persist through downturns.

Who cares about raising more money if the team fails to execute on a daily basis and burns cash unnecessarily? The startup graveyard is littered with casualties of poor execution.

How about we invest in developing skilled, effective founders that are able to execute at the highest level and build strong, scalable businesses?

Some readers might protest that venture capital firms and accelerators already do invest human capital in founding teams, but how intensively and effectively do they do that? Does a one-hour mentorship meeting with an “experienced operator” that offers scarcely more than general proclamations such as “talk to your customers” truly build sufficient internal capacity? Others might point to impressive resource libraries aimed at giving founders the information that they need to be successful, but this only goes so far. The challenge is not access to information; it’s wading through the vast quagmire of “resources” to find ones that are relevant to a founder’s unique situation and translating them into effective execution.

Academic research on learning estimates that people retain only 5% of what they hear (e.g. a mentor telling them what to do) and about 10% of what they read. Practical application, on the other hand, is 7-15 times more effective at building lasting skills and knowledge. Would you let a surgeon operate on you if the only training she got was via lectures and textbooks? Probably not, so why are we expecting the same of new founders? The learn-by-doing or apprenticeship model has been employed and proven successful in skill-intensive disciplines ranging from internal medicine to car repair, yet the startup world is a late adopter in applying this to new founders.Â

Investing human capital in founders, building internal capacity, and de-risking execution might sound appealing, but you may ask ‘does it work?’ There is a growing body of academic research that shows that human capital is a much stronger driver of startup and entrepreneurial success than traditional capital, which has no statistical correlation on its own.

Beta Boom’s Venture Academy Model for Developing Skilled Founders

At Beta Boom, we have taken this thesis to the extreme, and we hope that our own experiences and experimentation can serve as a starting point for even more novel approaches to unlocking the potential of the next wave of founders, particularly those that do not fit the old Silicon Valley mold.

The very core of what we do in our venture academy came from our own desires as founders desperately wanting an experienced master by our side to help us figure out how to effectively implement tactics daily. Despite spending a decade of leading product innovation at dozens of startups and Fortune 500 companies, I still got stuck on practical challenges such as measuring marketing campaign performance or finding the right language for a cold outreach to interview prospective customers. It would often take me hours of googling and days or weeks of trial-and-error learning. If I felt and operated like a complete novice despite spending my entire career in Silicon Valley in startups like Google, chances were that founders that were not afforded the same career experience or exposure I had, shared the same or greater challenges.

After speaking to hundreds of founders over the past four years, my partner and I have found that nearly all new founders with whom we spoke longed for someone to guide them with implementation rather than dispensing conflicting strategic advice. Not surprisingly, the farther founders were removed from Silicon Valley or from tech, the greater their need was for support and apprenticeship. This is a particularly troubling reality because those same individuals are often trying to solve challenges that the Silicon Valley elites have neglected but whose economic and social impact are likely to be enormous.

Beta Boom’s venture academy is meant to develop skilled, knowledgeable entrepreneurs that are empowered to build fundamentally strong businesses. We focus on founders that have extraordinary insight into their customer and are at a point where they need to hone in on product-market fit and find a viable, scalable go-to-market channel. Each team that is admitted to the academy is paired with experts in lean product, startup marketing, and fundraising. These experts, our “coaches,” work alongside founders in practical working sessions. We do these workshops daily, so our founders can iterate rapidly and learn intensively in an apprenticeship-like format. All in all, our coaches are expected to spend at least 200 hours working alongside founders although the true number is usually in the 300-400 hour range.

The key pillars of Beta Boom’s venture academy are:

- Lean product, startup marketing, and fundraising experts working alongside founders to help them figure out how to implement tasks;

- Dual emphasis on both co-creation and building internal capacity;

- Skill-building through an apprenticeship-like approach;

- Daily working sessions to shorten iteration cycles to just one day rather than weeks or months;

- Operating in weekly sprints across product, marketing, and fundraising.

A typical week at Beta Boom starts with sprint planning on Monday. The coaches then do daily hour-long working sessions with each of their assigned founder teams. These working sessions might include writing a remote usability script or editing a cold sales email or analyzing data from a product experiment. At the end of the week, we hold a retrospective with our teams to assess what we accomplished in the week. We also ask ourselves how we can get better for next week.

In running two academy classes we have found some approaches work better than others. After experimenting with different levels of customization we have found that tailoring our support to what the team needs rather than pushing everyone through the same agenda produces better results. Having said that, we have also found that there is a base set of knowledge and skills that every founding team needs to master, so having a baseline of skill-building topics to cover is critical. For example, we make sure that each of our startups implements and tests analytics, session recording, and A/B testing platforms, which then allow us to run and measure growth experiments. We made the mistake of incorporating this in an ad-hoc manner in our first class, which left some teams falling behind.

(We have included, at the end of this article, Beta Boom’s checklist of topics that we seek to cover in our working sessions with the founders of early-stage software companies.)

Does Investing Human Capital to Develop Skilled Founders Work?

So has our approach been successful? Honestly, we are still early in accumulating data points, with just one class of six startups in 2018 and another program ongoing. Having said that, a great case study to reflect on is Fiveable from our first class. Fiveable was founded by Amanda DoAmaral, who was a Teach for America teacher in a low-income high school in Oakland, California before starting her company. Amanda had no prior entrepreneurial experience and had never worked in a tech company before joining Beta Boom.

Since we started working with her, Fiveable has grown their user numbers by almost 10x and revenue by a similar rate. They have also gone on to win multiple competitions and raise roughly $1 million in follow-on investment to date. It’s impossible to know how she would have fared on her own without a counterfactual, but Amanda has stated several times that she would not have survived without having participated in Beta Boom’s academy.

Early indicators and past research support that our model of investing human capital to develop skilled and effective founders should yield better results, and time will be the ultimate decider. In the meantime, we hope to see others innovating on operational execution support rather than just financial structures.

How You Can Develop Successful Founders

How can investors and startup supporters invest transformative human capital in their portfolio founders? It is not necessary to have dedicated experts on staff to provide a much more effective level of support and skill-building. For example, we teamed up with an excellent growth marketing consultancy, Tuff, for this year’s Women’s Startup Academy to provide coaching on startup marketing. Even though we had startup marketing experience on staff, Tuff’s team brought unmatched depth and breadth. Individual angels and smaller firms might also collaborate with others to provide expert hands-on support and training. The most important points are to keep the startup team executing efficiently and build internal capacity, so they can continue to execute efficiently on their own long into the future.

While there are many finer points that we have refined over the past few years, we hope that what we have shared above provides a seed for innovating your own human capital investment. We are always open to speaking with other investors that are committed to helping overlooked founders succeed, so please feel free to reach out to us at sergio[at]betaboom[.]com or kimmy[at]betaboom[.]com.

Venture Academy Checklist for Early-Stage Software Startups

Product

- Conduct competitive analysis including their ideal customer, positioning, key features, key benefits

- Use your top 3 competitor’s products regularly

- Compose qualitative customer interview script

- Conduct interviews with potential customers

- Conduct interviews with current customers (weekly or monthly)

- Conduct usability test to identify usability issues weekly or monthly

- Conduct customer survey to gauge how well you are targeting your ideal customer

- Measure Net Promoter Score

- Measure what proportion of customers would miss the product

- Implement a system for capturing and tracking product enhancements

- Brainstorm and prioritize product enhancements

- Set up and test analytics, session recording, and A/B testing

- Measure outcomes of weekly product experiments

- Create a weekly dashboard of key metrics and North Star Metric

Marketing

- Marketing competitive analysis with your closest 5 competitors

- Calculate maximum customer acquisition cost (CAC)

- Identify channels that cost less than max CAC

- Brainstorm marketing channel tactics including hypothesis, channel, and stage

- Measure outcomes of weekly marketing channel tactics/experiments

- Diagram full conversion funnel and measure conversion rates across each step

- Identify and prioritize conversion rate optimization (CRO) experiments

- Run and measure CRO experiments on a weekly or daily basis

Fundraising

- Assess investment profile based on Team, TAM, Tech, Traction, Timing, Terminal Value

- Create strategy to boost investment profile across 5 T’s

- List assumptions in success sequence with corresponding validations

- Implement monthly investor update

- Create pitch deck and one-pager

- Create fundraising strategy considering equity investment, debt financing, revenue share, grants, and competitions

- Create data room with detailed competitor analysis, financial projections,

- Create target advisor/mentor and investor lists

- Implement automated outreach system such as using an email marketing platform

- Implement a system for tracking outreach and relationship development