Kauffman Foundation, SURGE, Blink, Global Entrepreneurship Network (Startup Genome), among others all offer individual rankings for the entrepreneurial ecosystems across various regions. Each includes a measure of the density of either high-growth companies or mature ones. The fact is both are important indicators that can also influence another metric — the quality and strength of the workforce.

Given that workers currently spend a median of 4.6 years at a given job (and for ages 25-34 only 3.2 years), in deciding to relocate for a specific opportunity, people often look at what their next jobs may may be within that market. A tipping point occurs for many growing ecosystems such as Chicago and Austin such that there are so many opportunities that attracting talent becomes easier and the population growth accelerates. These opportunities need not only be within startups but often include more mature businesses as well. The transference of work talent spills over in both directions and they catalyze each other.

In thinking about the maturation of ecosystems, it is commonly believed that each region should stand for something and “own” a vertical to make a mark for itself. This rings true for me and my marketing background as we often talk about having very focused positioning for a well-defined and narrow target segment. In the startup world itself, we repeat the need to do one or two things well and not be everything to everybody.

In Startup Genome’s 2018 report, they state:

In this new era of tech, one strategy for smaller ecosystems to increase their footprint is to focus on specific sub-sectors in either verticals or deep tech areas where they have existing strengths. Only a few ecosystems can be the top-performer in the world across the board, but many smaller ecosystems have the potential to become a top cluster for specific sub-sectors.

Startup Genome’s 2018 report

Further, the report identifies the unique opportunities that we’re seeing today due to fundamental shifts in emerging technologies:

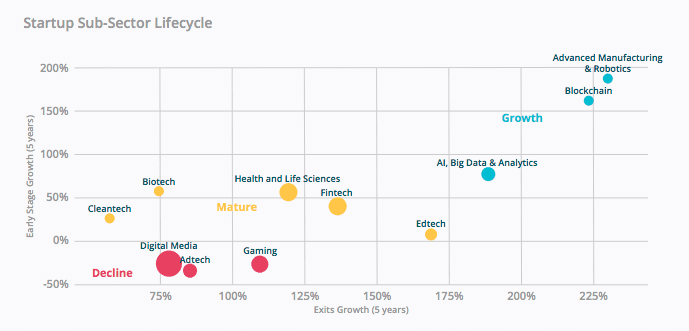

The types of companies that fueled the first and second generation of global startup ecosystems–social media apps, digital media, and other pure internet companies–are declining…. we see strong up-and-coming ecosystems in specific sectors like Fintech, Cybersecurity, and Blockchain.

Startup Genome’s 2018 report

The top growing industries are as follows (based on 5-year increase in early stage funding deals):

- Advanced manufacturing & robotics (+189% 5y)

- Agtech & New Food (+171% 5y)

- Blockchain (+163% 5y)

- Artificial Intelligence, Big Data & Analytics (+77.5% 5y)

These are all great observations that can provide guidance for rising tech scenes. For those emerging markets that already see a trend or potential in one of these segments, it makes sense to pour any limited resources into fostering the growth of that sector. But what if none clearly exists? Where do you start?

Mapping the change

Understanding your starting point is the first step to mapping possible change. Where do your current industry and skills strengths lie? The Startup Genome project offers a methodology of assessment here too. I like the cluster method to first map the clusters of industries, but then the next layer is often overlooked, what cluster of skills exist and how might they be transferable to other industries?

A word of caution here is to not just blindly pick one of the top-growing sectors. You must first understand where your strengths and weaknesses lie. This change is a long one that requires a lot of time, money and effort. Being clear on the objective and the reasoning for that target is more important than jumping into execution as it saves a lot of wasted resources. Building depth from scratch will mean fighting an uphill battle.

Understanding where you have depth now will help you to pick a good target and focus. For instance, for regions that have a long history in manufacturing, there would be many skilled workers that are well-versed on assembly and operations. The potential skills here may suit well for hardware innovations or perhaps SAAS ops tools, with the right additional training and support in the technological fields. The point is to leverage your existing strengths and not just build a new innovation center for signaling purposes.

Coordination toward meeting needs

At the mapping phase, we can get caught up at looking at organizations or resources, instead of assessing the needs that need to be met or as Clayton Christensen would say the “jobs to be done.“

Once we understand our starting point and the jobs to be done we can then move on to mobilizing players — those that can help with effecting change. Understanding the players, both within and outside of the ecosystem, that can help effect change can amplify efforts instead of leaving it all in the hands of the central economic development groups. In the same way that coordination is needed at the ground-level of the ecosystem, it is also needed at the underlying organization level. Their input at the planning phase is critical too in order to not only get their unique perspectives but also get commitment through co-creation. Depth and breadth at this level is vital so that bias is removed in the decision-making.

Here too, leverage what you already have on the ground and don’t just seek outsiders. Being too externally focused can alienate those who are critical to the fabric of your ecosystem and could help with building the new future.

What about those that don’t fall into the deep category?

With this choice to focus on a singular area in which to build for depth, it is only natural that some will feel abandoned. In the longer horizon, I do believe that rising tech regions can do more that one or two things well, but with limited resources focus is absolutely needed at the outset. Knowing that the future will likely be more broad, I would say that certain infrastructure can be put in place to support all startups. For example, investor platforms and events connected to a wider array of investors could pull outside investment for other verticals where there may be none or few on the ground. Similarly basic business management events and trainings are a common denominator. These could be leveraged by both the core areas and tangential ones as well. Finding low-touch solutions and leveraging other efforts again amplifies the results for many and builds to the longer future.

Overall, extreme focus on building depth is likely critical to success, so that priority must permeate all decisions.